Let's choose a firm maybe. Standard consumers, with excellent credit score scores, are a vital base for a strong insurance coverage company. These customers correspond about paying their costs and insurance firms should award them with the best rates. On the various other hand, those with low or weak credit history might have fallen under a poor spot as well as had problem paying expenses for a period, but that does not instantly suggest that they're going to be reckless when traveling.

Insurance providers are all regarding threat and numbers, as well as if their study claims that people with poor credit are commonly bad chauffeurs, one might make the debate that charging greater dangers is sensible. Also if it kind of seems like the insurance company is kicking the person with negative credit rating while they're down.

Customers with reduced credit report occasionally won't certify for monthly billing, or they might require to pay a large percentage of the plan up front as well as the rest monthly. In any situation, reasonable or not, credit report frequently do have an impact on one's insurance premiums. So, if you desire them to decrease, it makes sense to try to make your credit history go up.

The more insurance coverage you obtain, the much more you will pay. If you get a simplistic responsibility plan that covers just what the state needs, your auto insurance policy prices are going to be less than if you acquired insurance coverage that would certainly fix your own car, also. Liability coverage tends to cost even more because the amount the insurer risks is greater.

While Drivers Face Rising Auto Insurance Rates, Top 4 Us … – An Overview

If you don't have sufficient obligation coverage, you could be filed a claim against for the distinction by anybody you harm. cheap insurance. The higher the insurance deductible, the much less the insurance policy company will have to pay– as well as the reduced your prices.

Without some kind of medical protection, if you do not have health and wellness insurance policy elsewhere, you might not have the ability to pay for therapy if you are injured in a crash you triggered. One way some motorists can limit their insurance costs is with pay-as-you-drive insurance (affordable car insurance). This kind of insurance policy bases the price of your costs on how much you drive, and also might take into account various other driving behaviors.

Otherwise, these motorists "pay approximately the same annual taken care of expenses for insurance coverage as an additional driver with high yearly mileage. So, low mileage drivers would have Article source the greatest motivations to switch to pay-as-you-drive."Besides possibly saving cash for reduced gas mileage chauffeurs, pay-as-you-drive insurance policy can give a motivation to drive much less. Explains Parry: "By elevating the marginal expense of driving it would influence people to drive a little bit much less – particularly for those with high danger factors as shown in high rating elements (as they have higher insurance policy expenses per mile)."Parry includes that the benefit of this incentive to drive less may extend past the cash saved by customers with pay-as-you-drive insurance policy."There would certainly be some modest take advantage of lowering various other side impacts from vehicle use – some moderate reduction in carbon as well as regional air emissions and also traffic jam as accumulated automobile miles driven is moderately decreased (credit)."Exactly how much is cars and truck insurance policy each year? Here's just how much the ordinary vehicle driver, with good debt and also a clean driving record, would pay for the complying with coverage quantities, based on Automobile, Insurance coverage.

The ordinary rate for 50/100/50 is. The ordinary rate for 100/300/100, with extensive and also collision as well as a $500 deductible is. Bumping state minimum as much as 50/100/50 expenses simply $129, so it's simply around $11 a month– Mosting likely to 100/300/100 from 50/100/50 prices, to increase your obligation protection.

The Best Guide To 15 Tips And Ideas For Cutting Car Insurance Costs – Investopedia

risks vehicle insurance insure car insurance

risks vehicle insurance insure car insurance

Average prices are for relative purposes. Your very own rate will depend on your driving account.

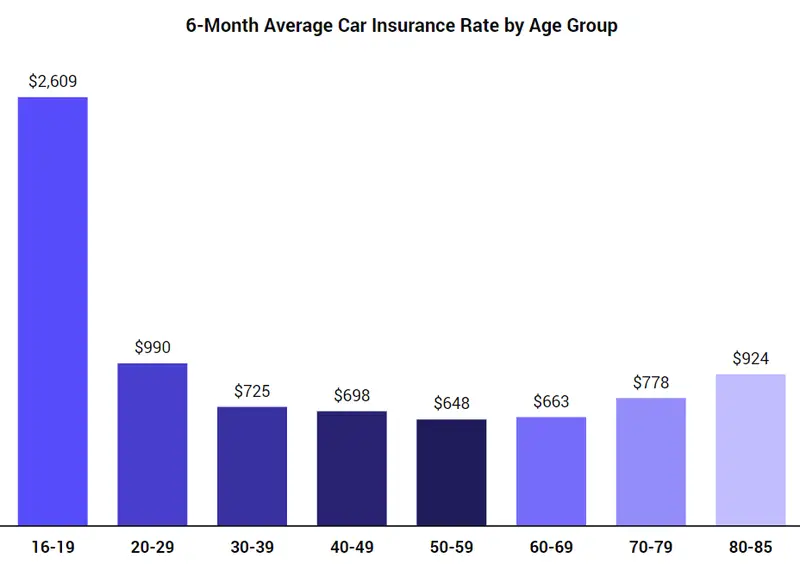

Normally cars and truck insurer will certainly bill extra for more youthful vehicle drivers and supply affordable prices for older chauffeurs. Insurance policy providers see young drivers as unskilled and also have a greater risk of entering mishap – auto insurance. In Texas, the normal teen vehicle driver in between the age of 16 and also 19 will pay $279. 82 per month while a vehicle driver in their 40s will certainly pay an average of $133.

38 More frequently than not, drivers who presently have vehicle insurance policy coverage will certainly get a more affordable regular monthly price than drivers who do not. Since auto insurance is a need in all 50 states, firms might doubt why you do not presently have protection.

Insurance coverage, Avg month-to-month rate Full Insurance coverage $138. We track and tape-record quotes that service providers have actually provided based on different standards. The rates and also standards shown on this web page must only be utilized as a quote.

Some Known Factual Statements About Car Insurance & Auto Insurance Quotes – Farmers Insurance

If you have an interest in locating an insurance representative in your location, click the "Representative, Finder" link at any time to go to that search tool (cheaper auto insurance). If you are interested in finding an agent that represents a specific company, you can likewise click on the business name in the premium comparison which will connect you to that business's web site.

In this post, we'll explore exactly how average vehicle insurance coverage rates by age as well as state can fluctuate. We'll also have a look at which of the ideal cars and truck insurance coverage companies use good price cuts on automobile insurance by age as well as contrast them side-by-side. Whenever you purchase automobile insurance, we advise getting quotes from numerous service providers so you can compare protection as well as prices.

credit score cheaper car insurance cars vans

credit score cheaper car insurance cars vans

Why do average automobile insurance rates by age differ so a lot? 5 percent of the populace in 2017 but represented 8 percent of the complete price of car accident injuries.

The price information comes from the AAA Foundation for Website Traffic Safety And Security, and also it makes up any accident that was reported to the cops. The ordinary premium information comes from the Zebra's State of Vehicle Insurance policy record – car insurance. The prices are for plans with 50/100/50 obligation insurance coverage limits and a $500 deductible for extensive and also collision protection.

Getting My A Guide To No-fault Insurance Laws In Michigan – Thumbwind To Work

According to the National Highway Web Traffic Safety And Security Administration, 85-year-old males are 40 percent more probable to get involved in an accident than 75-year-old males. Taking a look at the table above, you can see that there is a direct correlation in between the crash price for an age as well as that age's ordinary insurance policy premium.

Remember, you may locate better rates through one more business that doesn't have a certain trainee or elderly price cut. * The Hartford is only available to participants of the American Association of Retired Folks (AARP). Nonetheless, insurance policy holders can add more youthful chauffeurs to their policy and get discounts. Average Cars And Truck Insurance Rates And Also Cheapest Supplier In Each State Due to the fact that automobile coverage prices vary a lot from one state to another, the provider that supplies the most inexpensive cars and truck insurance coverage in one state may not offer the least expensive insurance coverage in your state.

You'll also see the typical expense of insurance policy in that state to aid you contrast. The table additionally includes rates for Washington, D.C. These rate estimates use to 35-year-old drivers with good driving records and credit report. As you can see, average cars and truck insurance policy expenses vary extensively by state. Idahoans pay the least for vehicle insurance, while drivers in Michigan pay out the big dollars for coverage.

If you reside in downtown Des Moines, your premium will possibly be greater than the state average (perks). On the various other hand, if you reside in upstate New York, your car insurance plan will likely set you back less than the state average – liability. Within states, vehicle insurance premiums can vary commonly city by city.

The 6-Minute Rule for The States Where Motorists Pay The Most For Auto Insurance

The state isn't one of the most pricey overall – affordable car insurance. Minimum Coverage Demands Many states have monetary obligation laws that call for vehicle drivers to bring minimal automobile insurance coverage (insurance companies). You can only forego insurance coverage in 2 states Virginia and also New Hampshire yet you are still financially in charge of the damages