It's complimentary and individuals have conserved an average of $555 when acquiring utilizing this online tool. Some car insurance coverage companies will not enable you to buy a non-owner policy if there are too lots of main drivers and vehicles noted on a policy.

You should talk to a representative to get a non-owner automobile insurance coverage quote. Follow these steps to purchase non owner insurance coverage, Contact an auto insurer representative about the protection. If non owner sr22 insurance is needed, supply the agent with your state notification number (if applicable– not all states need this).

Get details on offered companies and insurance coverage rate quotes. Supply a down payment to begin coverage. The insurance coverage business files an SR-22 straight with your state, if required.

Rumored Buzz on Credit Union In San Diego – California Coast Credit Union …

Who has inexpensive non owner vehicle insurance? Finding who has the most affordable non-owner insurance coverage quotes includes the exact same actions as discovering the least expensive expense standard policy.

Will My Premium Go Up if I Am Not at Fault for a Mishap? One fear numerous vehicle drivers have after a mishap is that their cars and truck insurance coverage premiums will increase. Even when motorists are not at fault for the crash, they often stop working to report the mishap to their insurer because they wish to avoid the feared dive in premium expenses.

A lot of states saw around a 40% boost, so California was practically double the nationwide average. Insurance coverage premiums increased even more. Insurance coverage rates didn't stay raised permanently.

Facts About Metlife: Insurance And Employee Benefits Revealed

What is California's Law on Premium Boosts after an Accident? If you weren't at fault for the accident, then we have some great news. California law will restrict an insurer from increasing your insurance coverage rate if you were not at fault for a crash. Several laws remain in play, however this summary from the California Department of Insurance coverage is useful.

This suggests that if you are not responsible for the collision, then the insurance coverage claim you sent can not be utilized by the insurer when setting your rates. California runs under a relative carelessness system.

Behind her, Jason has been tailgating Samantha and driving strongly. When Samantha slows down in preparation for making a turn, Jason slams into the rear end of her vehicle.

The Best Guide To Car Insurance Prices – State Farm®

But Samantha likewise bears some of the blame for the crashshe didn't use her turn signal, which would have notified those around her that she was preparing to make a turn at the intersection. Based on these facts, we can't state Samantha is completely blameless. She is a minimum of partly at fault for the crash.

The jury might find one motorist 40% responsible and the other 60%, or they may reach a various portion. Expect insurance coverage adjusters to thoroughly examine the facts of the case consisting of the cops report, your statements about what took place, and any witness statements.

Your cars and truck mishap attorney can likewise helpfully review a settlement agreement or even compose it so that your rights are protected. This is another reason why you should not admit fault at the scene of the accident, either. The other chauffeur makes certain to tell his/her insurer that you are claiming duty, and the insurance provider might firmly insist that you are principally at fault based on that factor alone.

Getting My Florida Blue: Florida Health Insurance Plans To Work

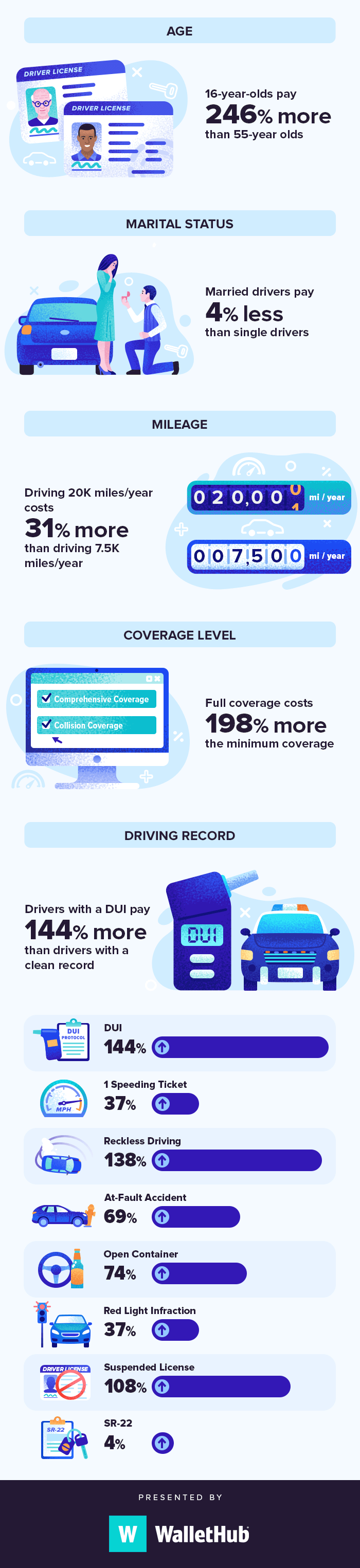

Did you understand that getting a traffic ticket in California or moving to a brand-new area can cause your car insurance rates to increase? Considering the amount of cash that we all invest on car insurance coverage every year, it's good to know why we're paying the rate that we are? Understanding how your rates are determined can assist you save money on your premium.

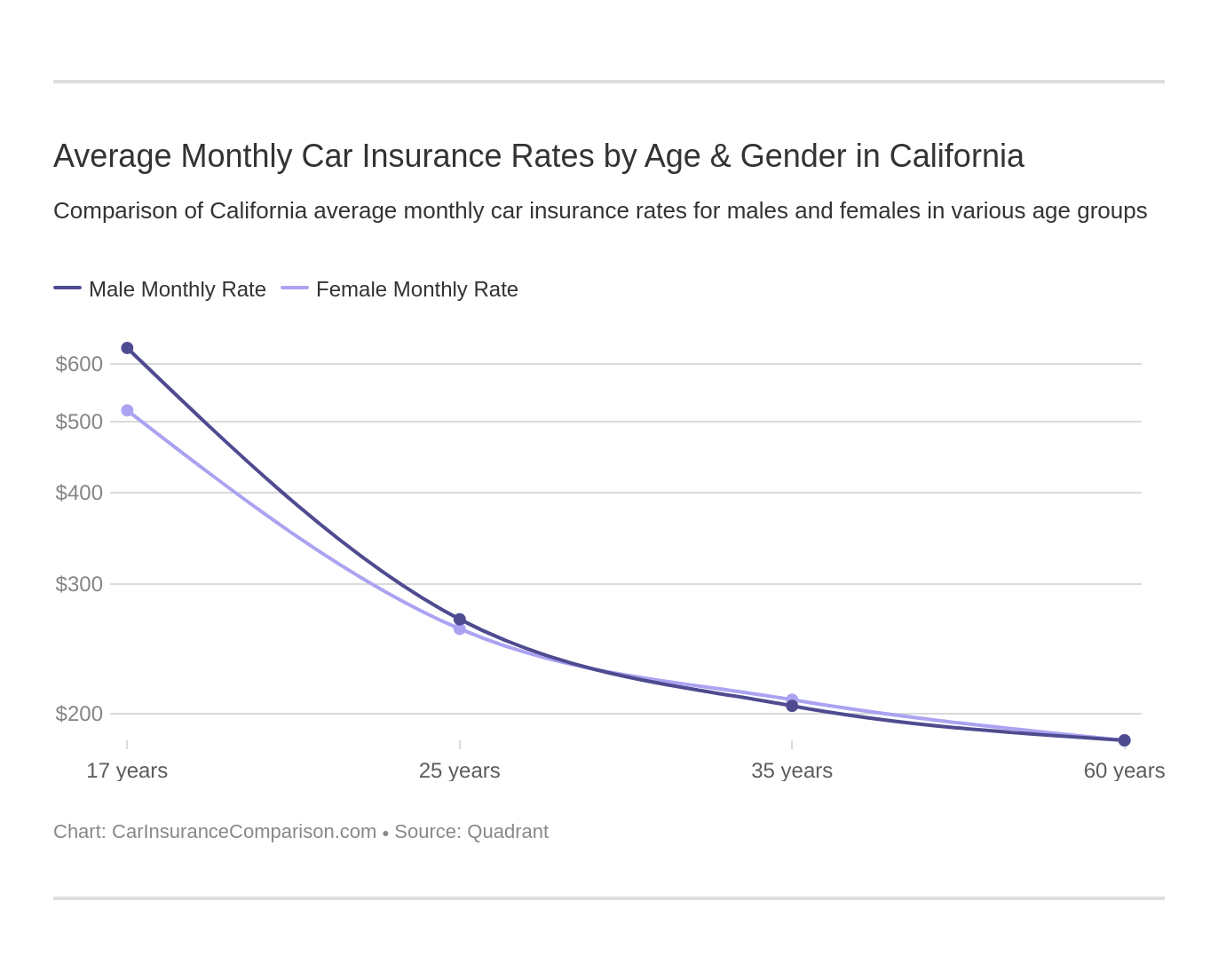

Vibrant chauffeurs will generally pay a higher rate considering that they are seen as more of a threat than chauffeurs who have been driving longer. – Research studies have revealed that, on average, guys pay more for auto insurance throughout their lifetimes than women. Sadly for men, your gender might trigger you to invest more on automobile insurance coverage.

If you have a bad rating you might end up paying a higher premium. – Where you drive, when you drive and how often you drive all impact just how much you pay. If you only drive for leisure your rates might be lower. If you commute to work or school every day this can cause in vehicle insurance coverage increase.

The smart Trick of Average Car Insurance Costs In California – Smartfinancial That Nobody is Discussing

What is the average annual expense of cars and truck insurance coverage in the United States? Discover out what factors impact the average rates of automobile insurance for the year, plus the minimum and optimum expenses for automobile insurance coverage. It might shock you to discover what factors effect average vehicle insurance costs. According to, a good driver with excellent credit pays an average of $1,555 every year for full protection cars and truck insurance.

Costs might differ due to something as simple as your place. With ever-growing premiums, some individuals might question if it is worth it to spend for vehicle insurance in the very first place. However something makes sure. If you don't get your cars and truck insured, a simple rear-end tap might end up costing you a fortune.

Years of experience behind the wheel matter. Even the most experienced chauffeurs can end up in a mishap, especially when it's caused by someone else. If you just bought a new vehicle, it's finest to consider guaranteeing it prior to you begin the engine and struck the road. Laws in each state differ and so do the minimum car insurance requirements from state to state.

The Cost Of Car Insurance Per Month – The Hartford – The Facts

https://www.youtube.com/embed/iTR2olQjL88In addition, learn about aspects that affect insurance plus the most pricey and the least costly states for car insurance. Each insurer uses a formula for computing danger and rates. To breakdown what insurance companies search for, here's some leading products cars and truck insurance providers research that affect automobile insurance rates in your state and regional area.